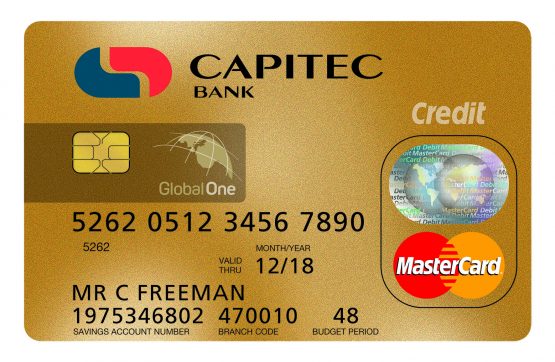

South Africa’s third-biggest bank, Capitec, has launched a new credit card that offers up to R150,000. Aptly called the Global One Credit Card, this Capitec offering provides customers with a huge credit limit and access to all of their accounts under one app.

Capitec offers the Global One Credit Card with a 55 days interest-free period. Under this credit card, cardholders can also earn 5.10 per cent per year by having a positive balance with the bank. Powered by Mastercard, cardholders will also have access to secured cashless payments with zero fees worldwide. These cashless transactions will be accessible through card machines, online, and through telephone and mail orders. However, this card provides personalised credit based on the applicant’s profile and affordability. Those who have bad credit might not be approved or might be given a higher interest rate.

Applicants who are interested in managing their accounts from a credit card can do so with Capitec’s new offering. Apart from transferring outstanding balances, this credit card also allows users to update their daily card limits via the Capitec app.

Customers can get Global One Credit Card by checking out their eligibility through the online estimate calculator before proceeding to a branch near them. Primary requirements by the bank include being at least 18 years of age or older to apply, stamped bank statements showing 3 latest salary deposits, latest salary slips, and original proof of residence. Bear in mind that interested customers should have a minimum salary of R3,000 to qualify for this application.

Prospective customers should keep in mind the fees that come with this credit card. Aside from the interest rate ranging from 10.25% to 20.75%, there is also an initiation fee of R100 and a monthly fee of R35. Fees can change depending on the cardholder’s active balance and the number and amount of balance transfers incurred by the applicant.